Accommodations Tax

This tax is charged for the leasing or renting of any room, hotel/motel room, or other public accommodation located in the city and used for overnight lodging purposes (for less than a 30-night stay). The current accommodations tax rate is 7.5%.

Admissions Tax

This tax is charged for admission to an event such as concerts, nightclubs, and theatres. The tax rate for admission to an event is 5.0% of the price of the ticket or admission. Any admission fee paid or charged to participate in a racing event which includes running, walking, biking, or swimming is exempt from this tax.

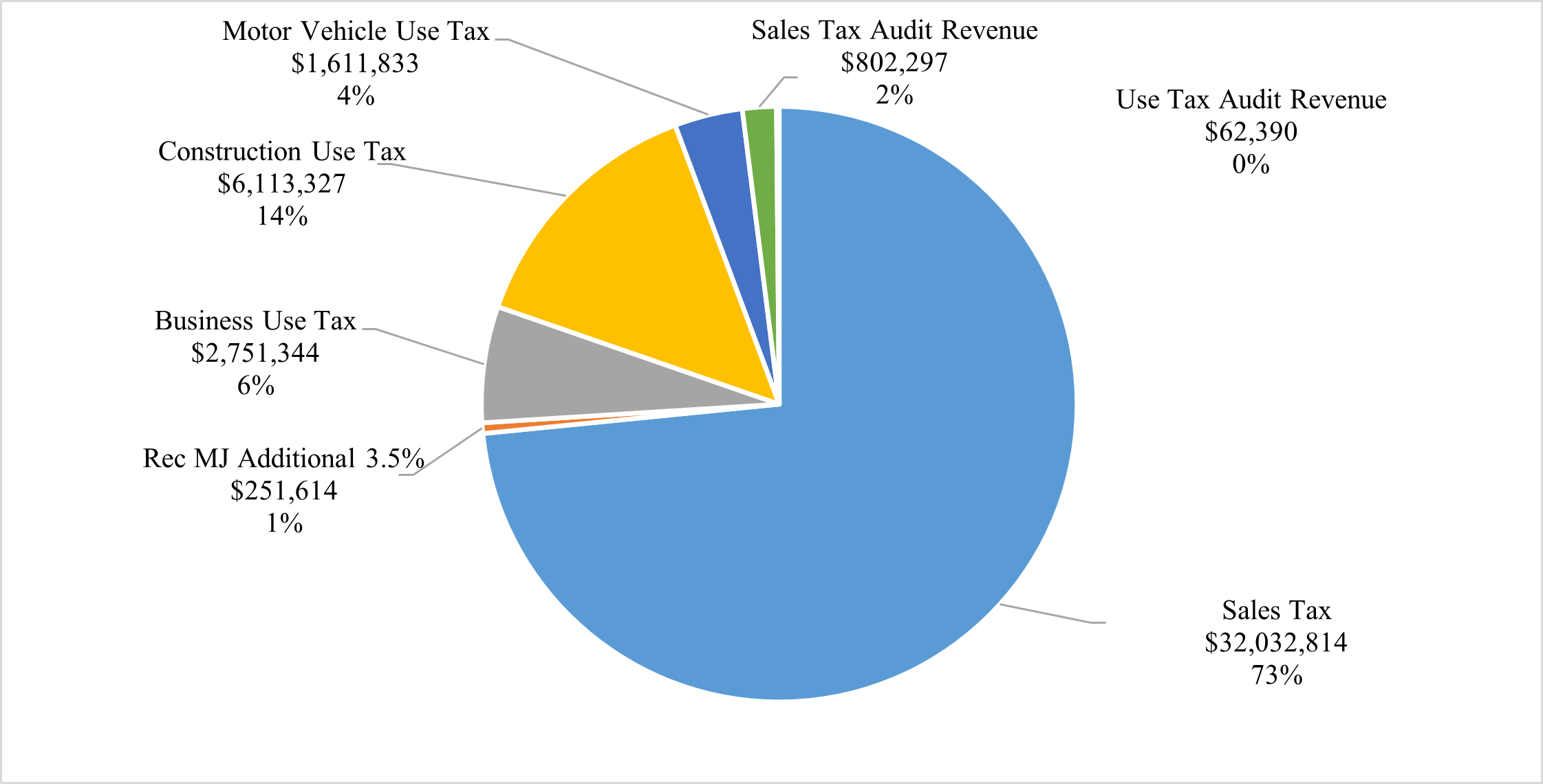

Business Use Tax

Use tax applies to all furniture, fixtures, equipment, supplies, and materials purchased for use by businesses that are not for resale. If a person or business hasn’t paid the proper city sales tax to the vendor on a taxable purchase, they must report use tax directly to the city. The current City of Boulder use tax rate is 3.86%.

Construction Use Tax

Construction Use Tax is paid at the time of a building permit application and is based upon 50% of the valuation of the project. If the project valuation is more than $75,000, after the project is complete the contractor is required to file a reconciliation return to determine whether additional tax is due, or a refund is due based upon the actual value of taxable personal property and services included in project. This tax is therefore dependent upon the number and value of construction projects permitted in a year and can vary significantly year to year, and because it is collected at the time of permitting the revenue is in advance of visible construction activity. The current construction use tax rate is 3.86%.

Disposable Bag Fee

The city requires a 10-cent fee on all disposable plastic and paper checkout bags provided by stores in Boulder. The bag fee does not apply to certain types of disposable bags including those provided by restaurants, bulk or produce bags, newspaper bags, or any other kind of food packaging bags. The city council intends that the requirements of the bag fee imposition will assist in offsetting the costs associated with using disposable bags including mitigation, educational, replacement, and administrative efforts of the city.

Electronic Smoking Device Tax

This additional 40% sales tax is applied to the retail sales price of Electronic Smoking Devices (ESDs) containing nicotine including any refill, cartridge, or any other component of such product. This tax is in addition to the city’s 3.86% sales and use tax levied on the sale of ESDs.

Food Service Tax

This tax is applied to food and beverage sold in or by food service establishments. The food service tax of 0.15% is added to the current sales tax rate of 3.86% resulting in a total tax rate of 4.01%. This tax is not applied to food purchased for home consumption from grocery/convenience stores.

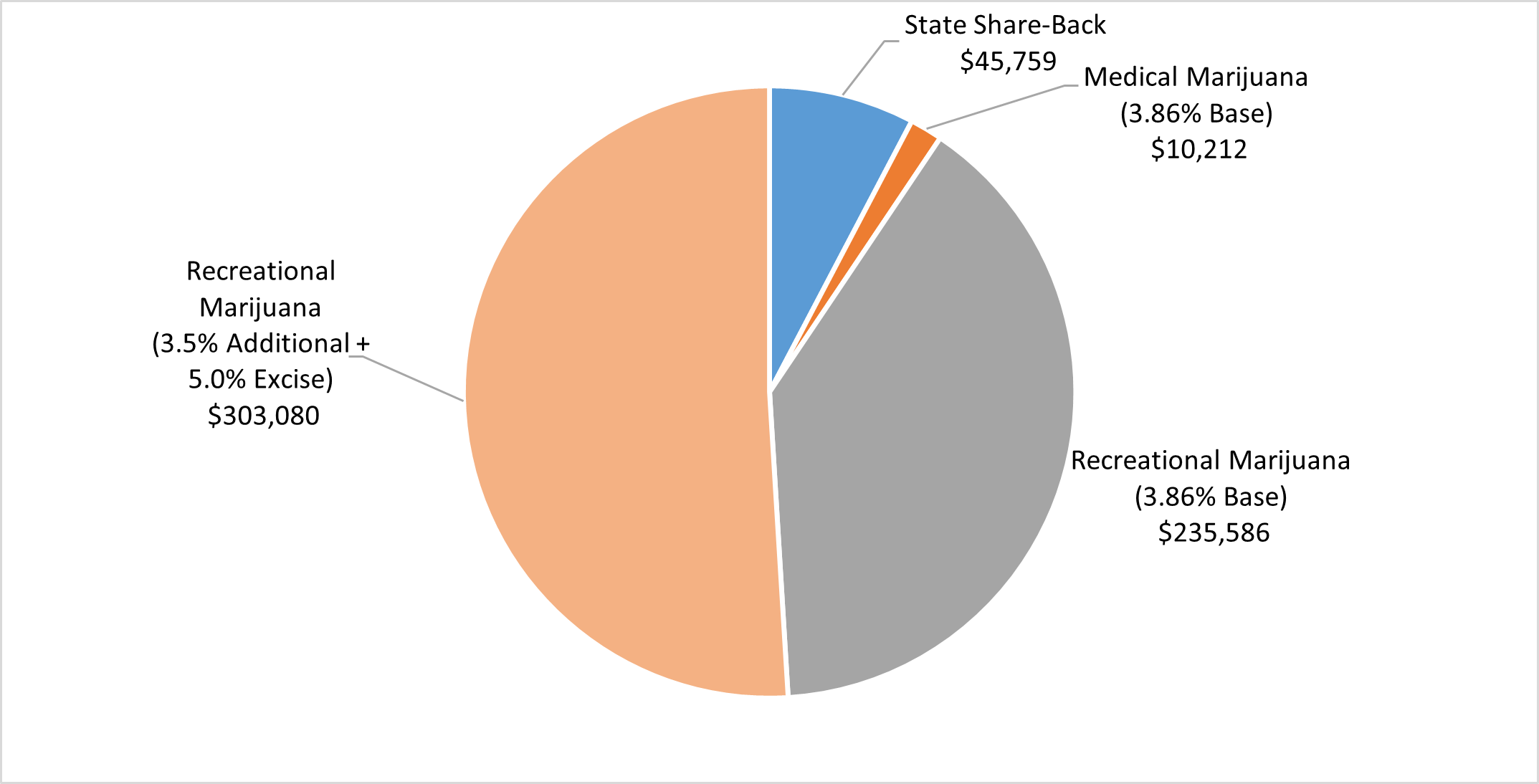

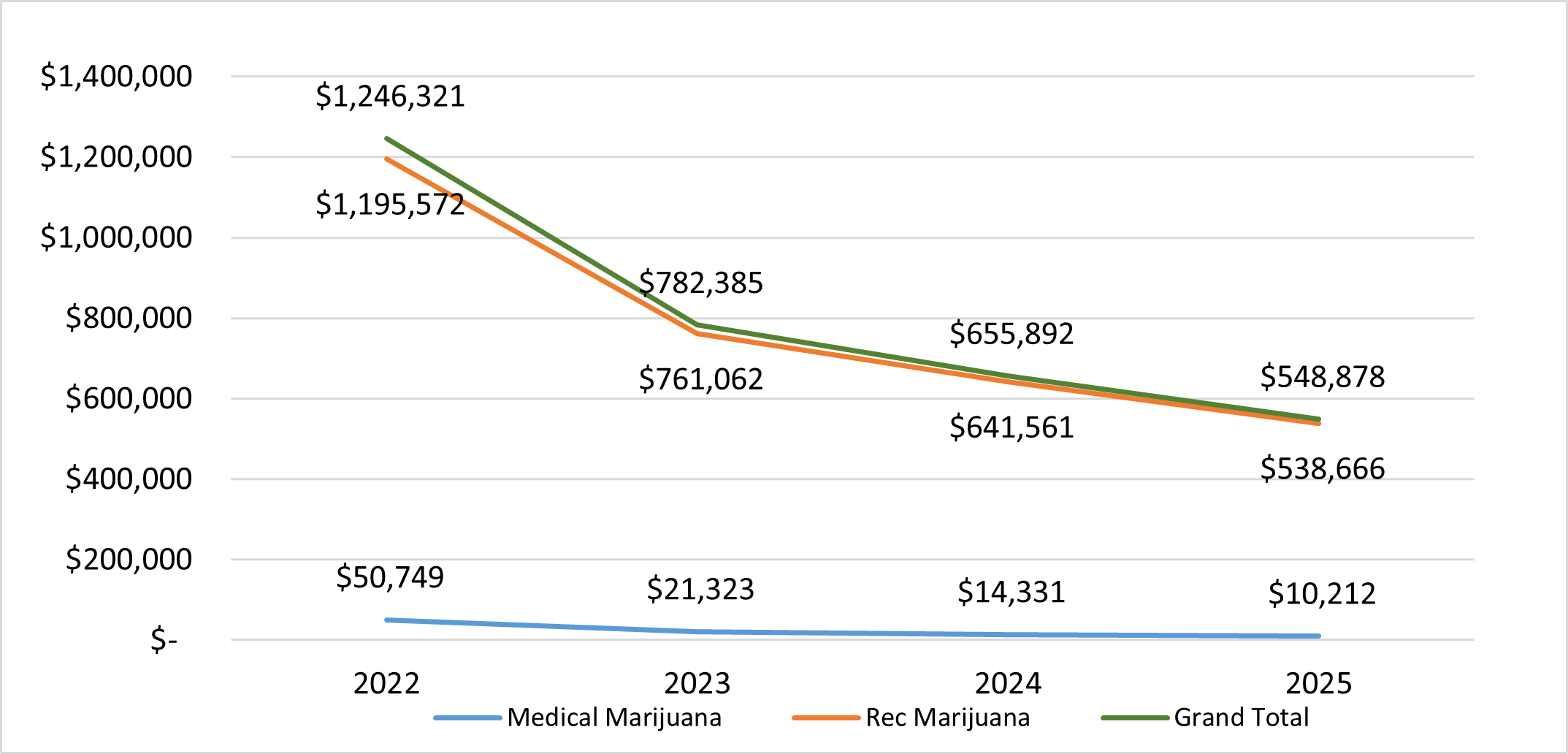

Marijuana Taxes

The city’s 3.86% sales tax applies to the sale of both medical and recreational marijuana. In addition, the city has a 3.5% additional recreational marijuana tax and 5.0% excise tax on the transfer of marijuana from a recreational marijuana cultivation facility to a marijuana infused product facility, testing facility or recreational marijuana store. In addition, the city receives a revenue share back from state recreational marijuana taxes.

Motor Vehicle Use Tax

If sales tax is not paid at the time of purchasing a vehicle, a Motor Vehicle Use Tax is due at the time a vehicle is registered or titled to an address within the city. The current use tax rate is 3.86%.

Short Term Rental Tax

This tax is charged for leasing or renting properties by Boulder homeowners for less than 30 days at a time. The current short-term rental tax rate is 7.5%.

Sugar Sweetened Beverage Product Distribution Tax

The Sugar Sweetened Beverage Product Distribution Tax is a voter-initiated tax that was adopted by Boulder voters in the November 2016 election. It places a 2-cent per ounce excise tax on the distribution of beverages with added sugar and other sweeteners. Revenue will be spent on health promotion, general wellness programs and chronic disease prevention that improve health equity, and other health programs (especially for residents with low income and those most affected by chronic disease) linked to sugary drink consumption.

Trash Tax

The trash tax is an occupation tax on trash haulers serving customers within the city limits and helps fund waste reduction efforts in Boulder. Most haulers pass the tax on to customers as part of their trash service bills. Boulder also has a waste hauling ordinance that applies to all haulers. The current trash tax rates are $3.50 per month for households and $0.85 per cubic yard of trash for businesses and multifamily units that use centralized dumpsters.