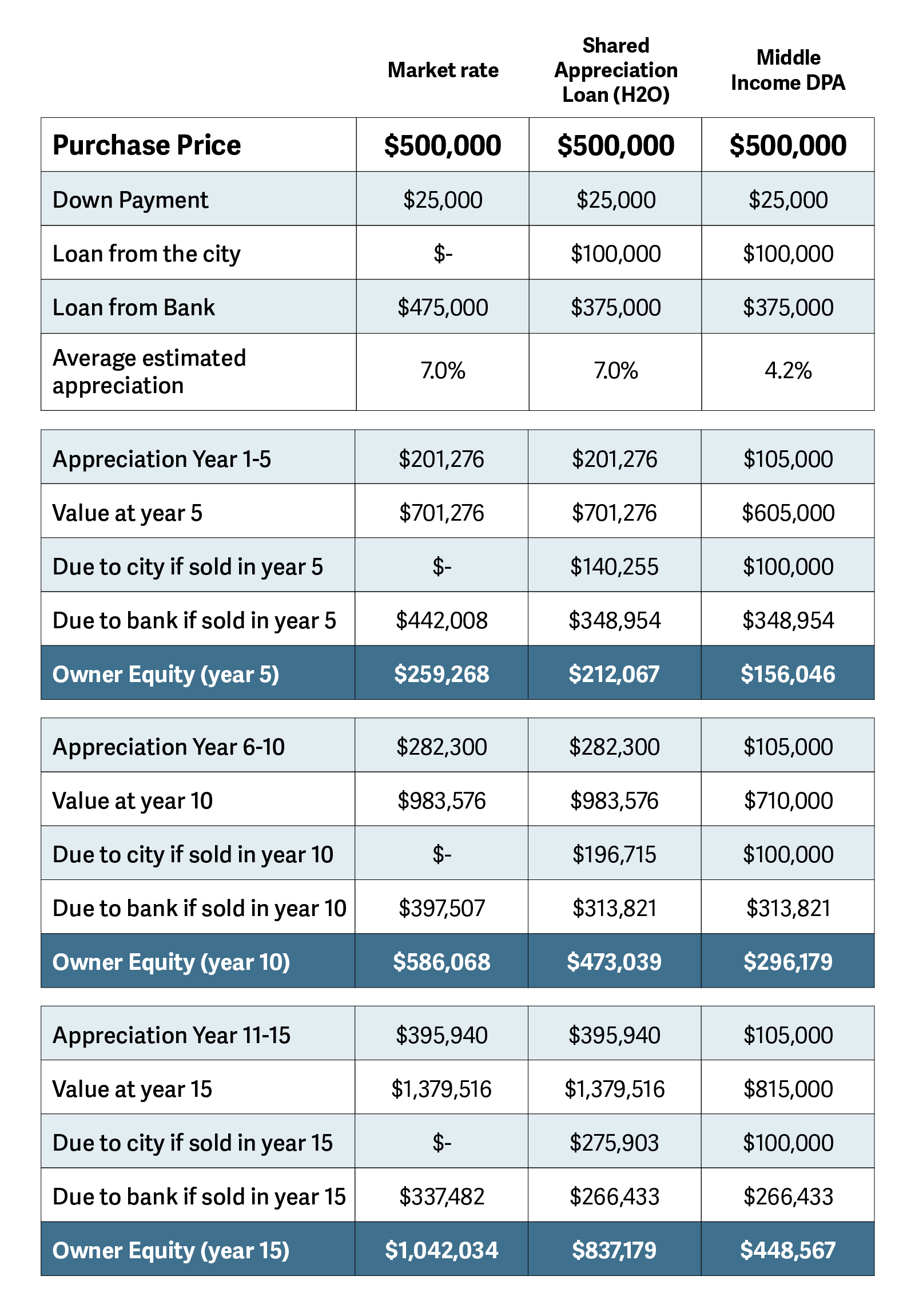

Homeownership is one way people invest. The City of Boulder's down payment assistance programs allow buyers to invest and build equity or wealth. However, the programs have clear parameters on how equity can be built which can limit equity.

The table below explains equity growth in three different scenarios to illustrate the limits of the city's down payment assistance programs. If you have additional questions, please reach out to the city's homeownership team at homeownership@bouldercolorado.gov or by phone at 303-441-3157.