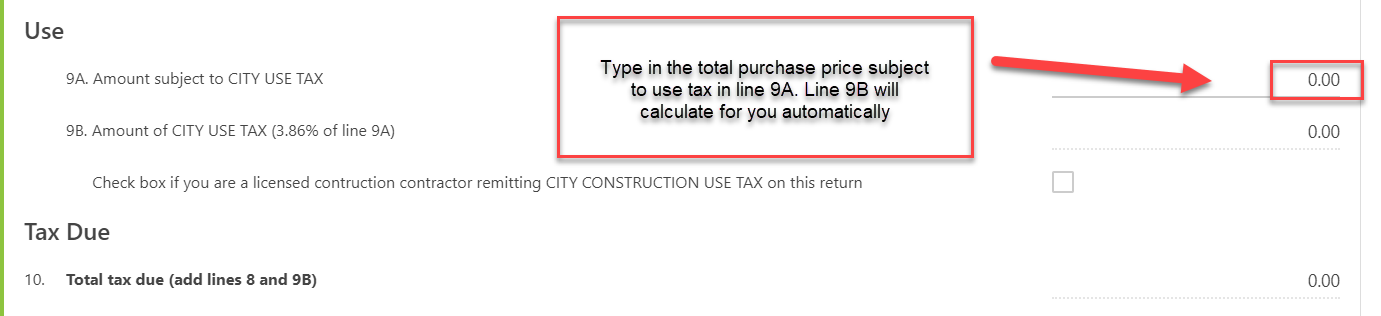

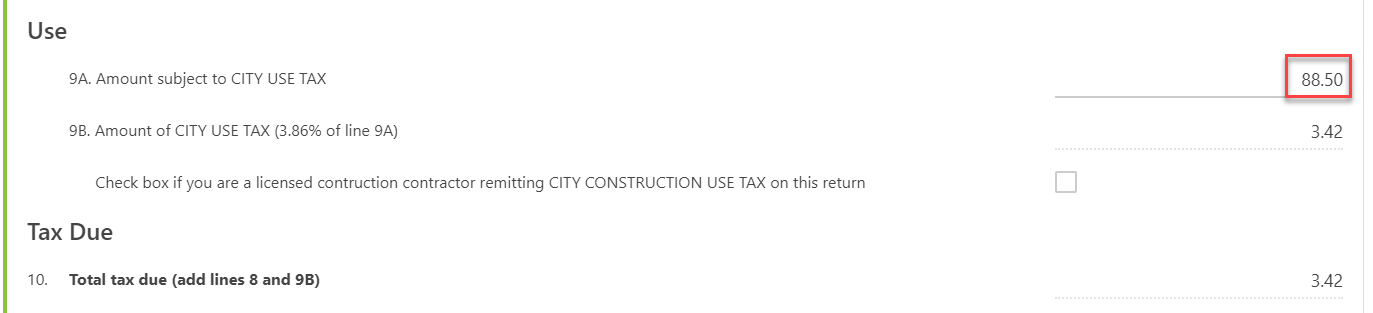

Use tax must be paid by City of Boulder businesses and individuals for purchases brought into City Limits that did not include City of Boulder sales tax or when inventory acquired at wholesale is used by the business, instead of being sold to customers. The city use tax rate is the same as the sales tax rate: 3.86%. With proof of payment, sales tax paid to another tax jurisdiction may be credited against consumer use tax due for a particular item.

Use tax is intended to protect local businesses against unfair competition from out-of-city or state vendors who are not required to collect City of Boulder sales tax. It ensures that all City businesses and residents help fund City services regardless of where they shop. Many tax jurisdictions have a use tax imposed when sales tax is not collected. The State of Colorado also levies Use Tax on purchases where Colorado State Tax is not collected.

For more information see the Use Tax section of our Tax Regulations page.