Welcome to the City of Boulder!

Thank you for choosing to participate in a City of Boulder special event. Special events in Boulder are essential to making our city the wonderful place that it is. The following information is about the sales tax rate held in the City of Boulder.

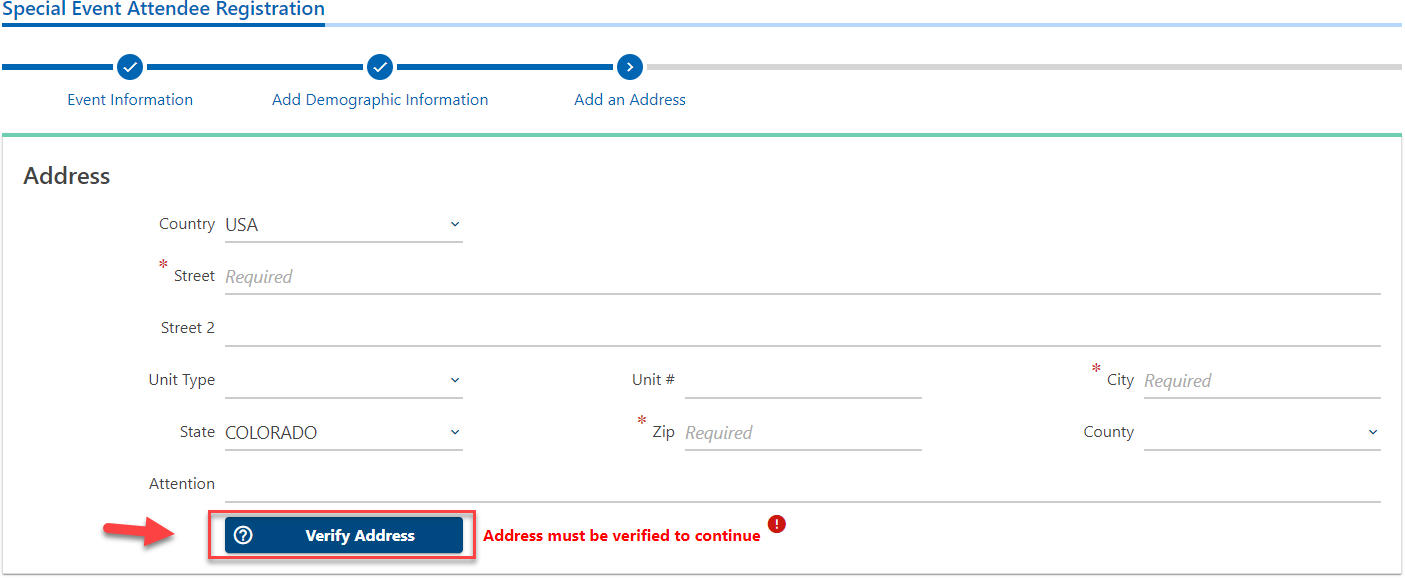

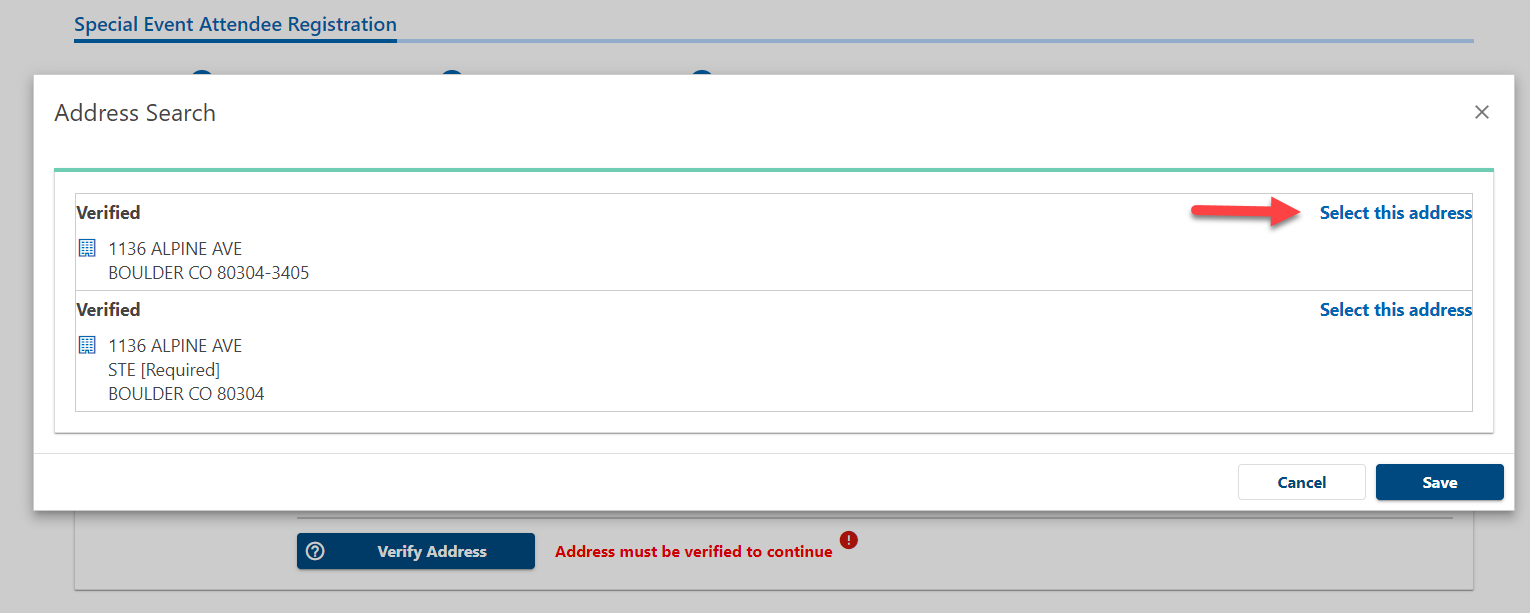

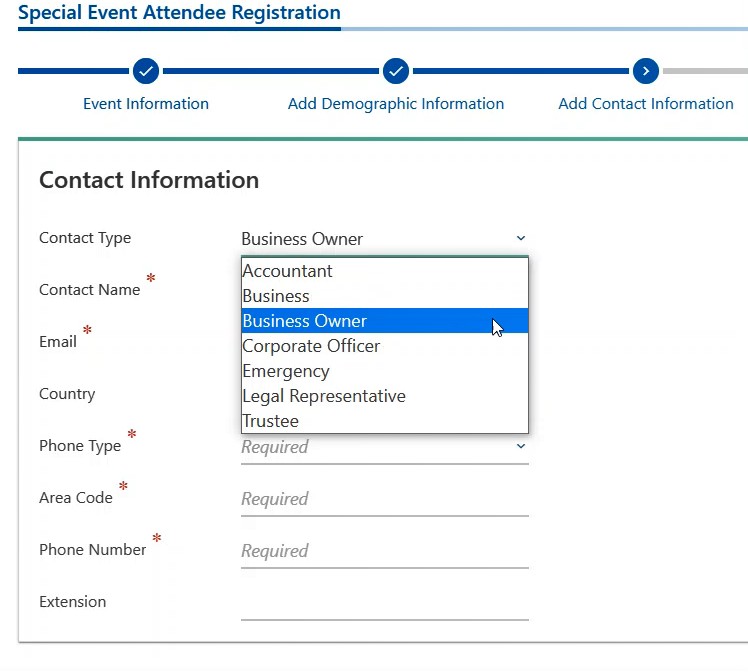

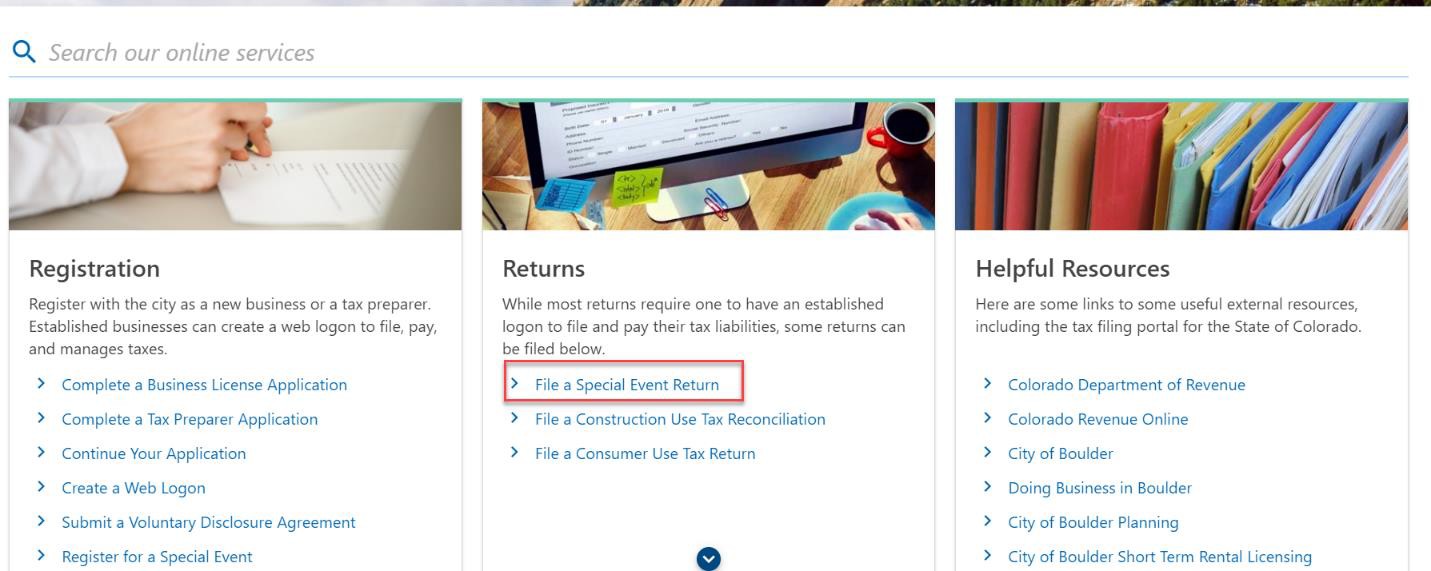

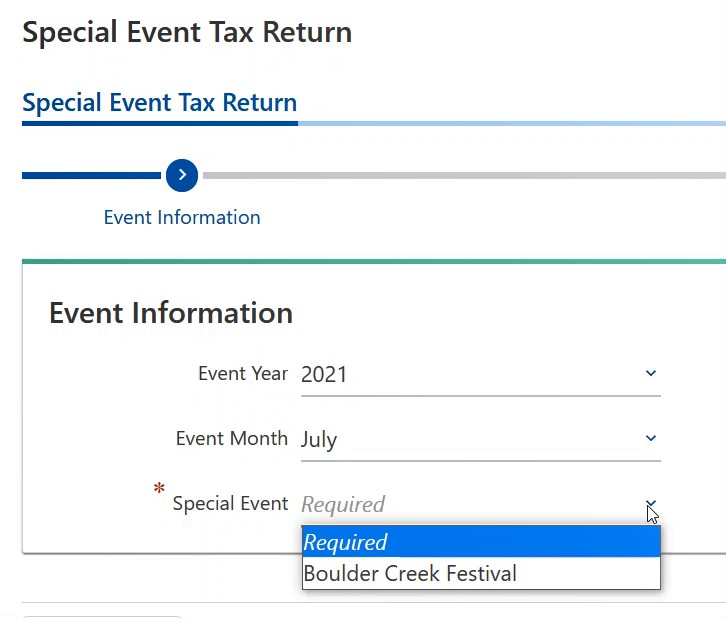

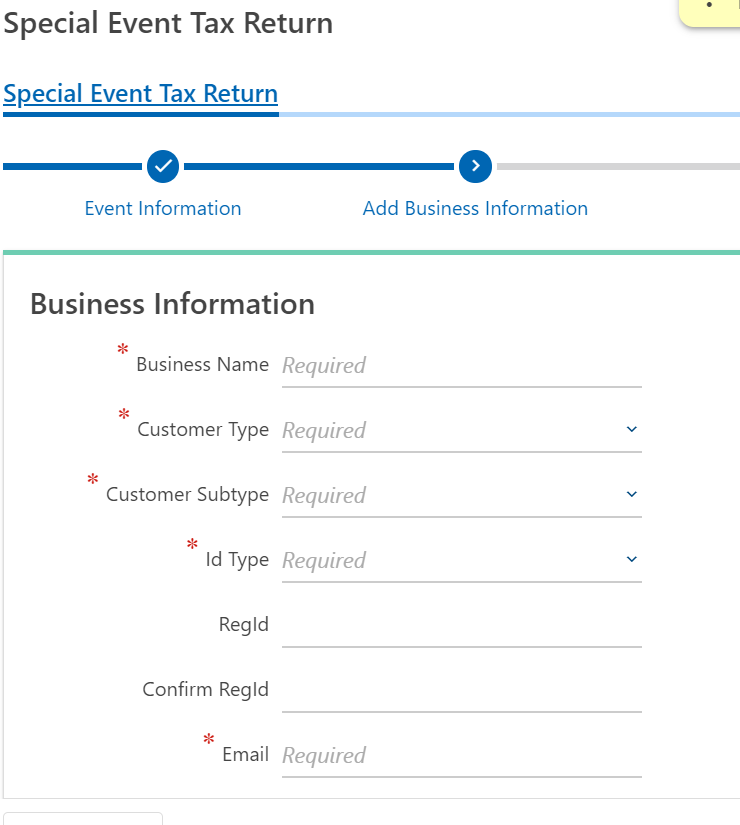

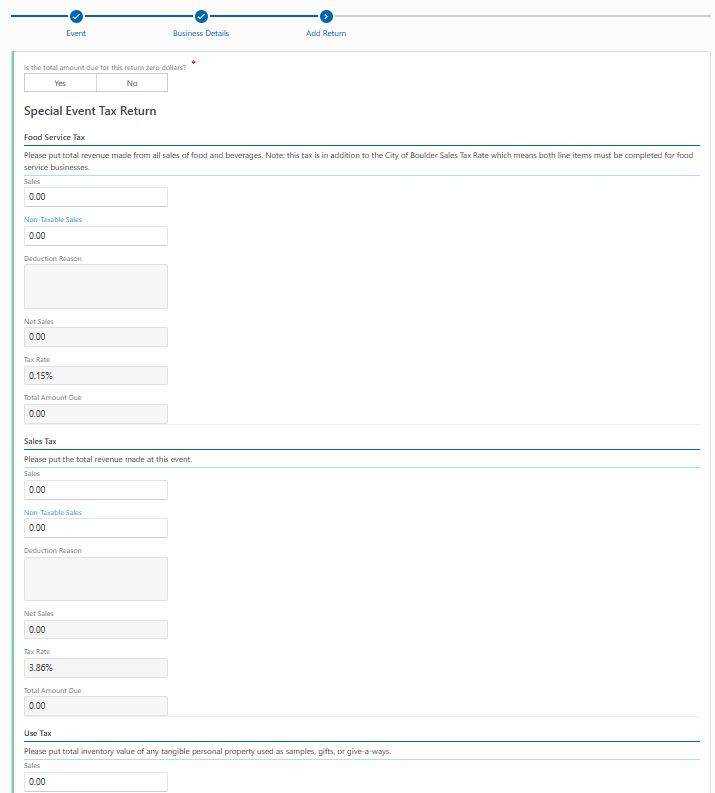

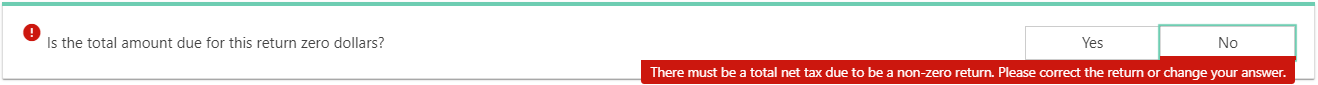

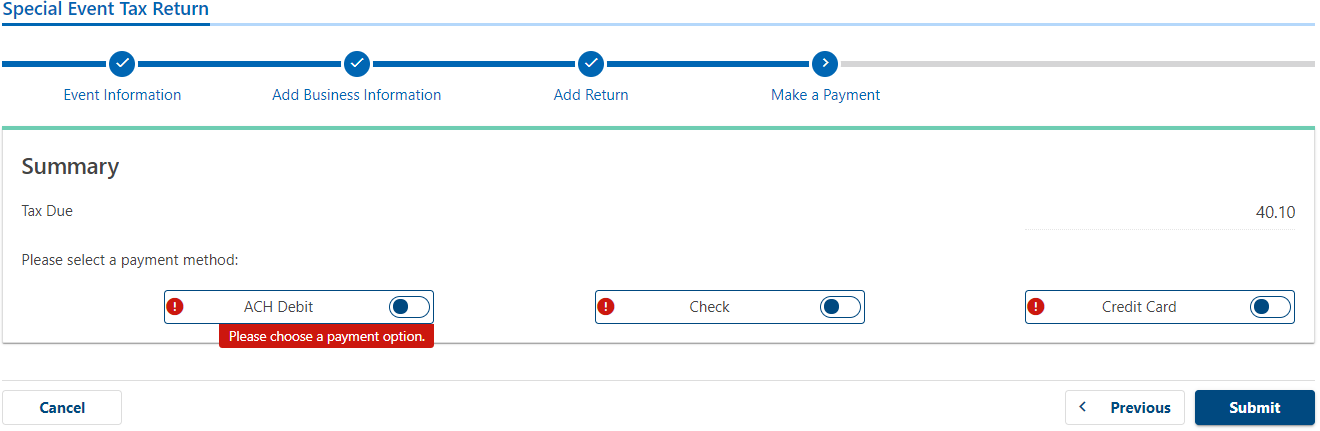

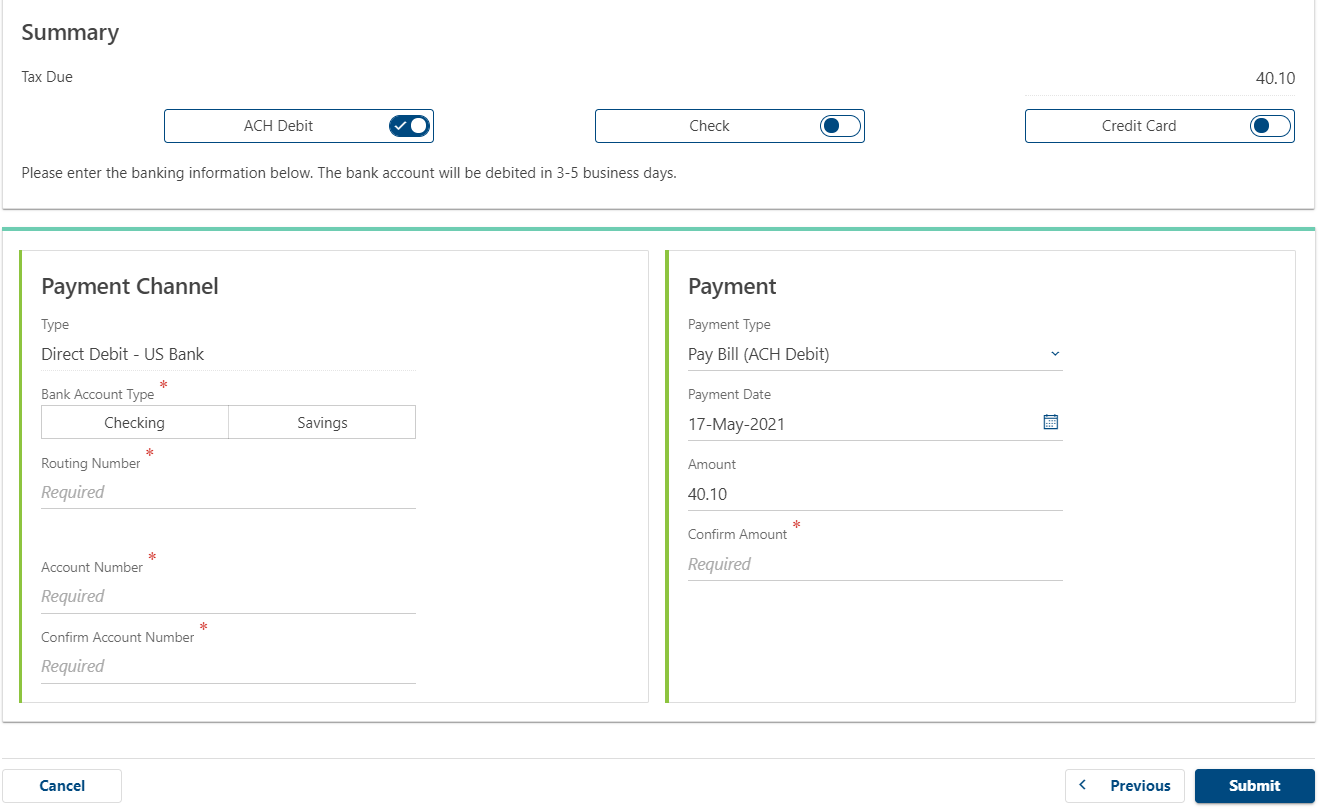

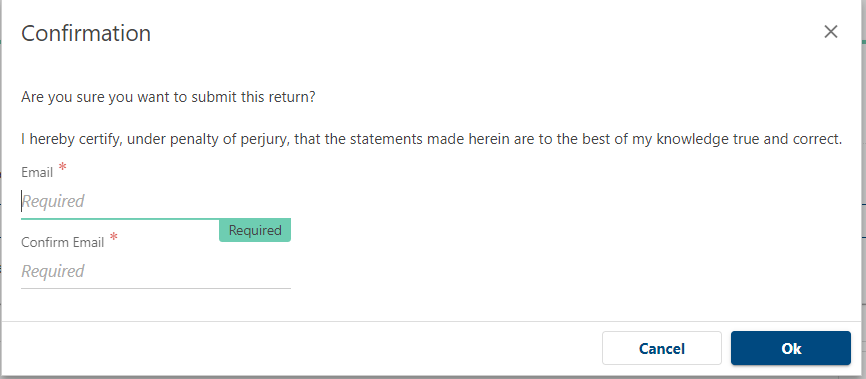

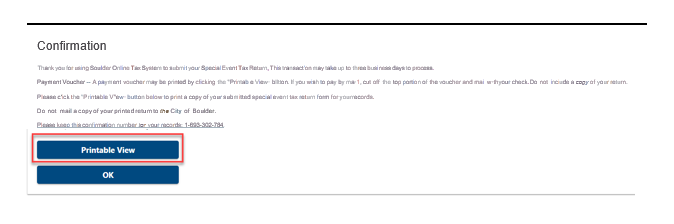

Every participating business at this event is required to remit a sales tax return to the City of Boulder. A special event tax return can be filed via Boulder Online Tax.

Tax returns are due by the 20th of the month following your event.

Please be thorough when remitting sales tax. Your accuracy is essential to showing the economic effect of special events on the City of Boulder.

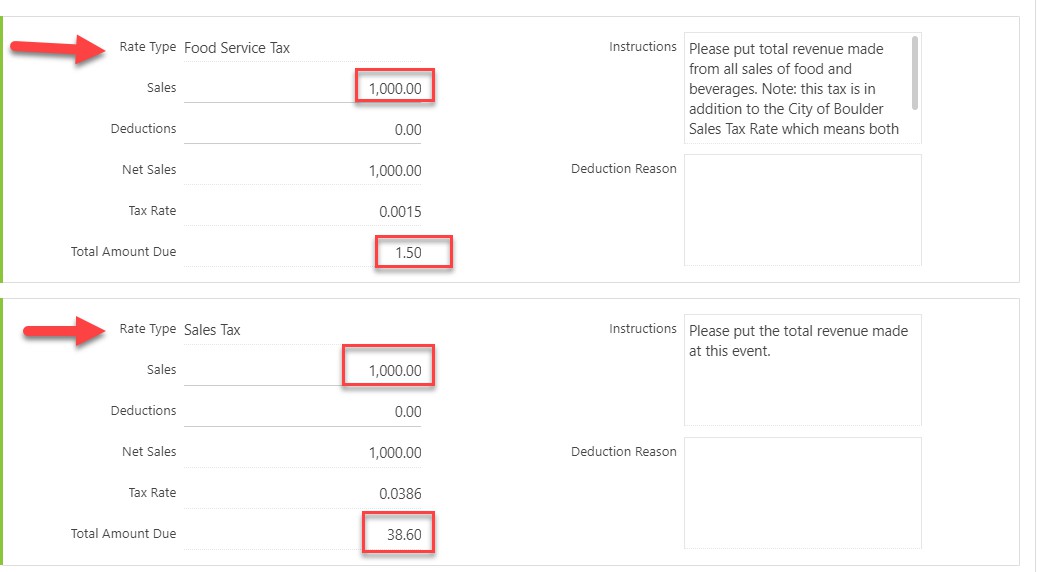

Current Tax Rates

Thank you for your cooperation! We hope to work with you again soon!

Sincerely,

City of Boulder Sales Tax Team

salestax@bouldercolorado.gov

Basic Special Event Tax Information

Thank you for choosing to participate in a City of Boulder special event. Special events in Boulder are essential to making our city the wonderful place that it is.

Here is some information about tax in the City of Boulder which hopefully you will find useful for your upcoming event.

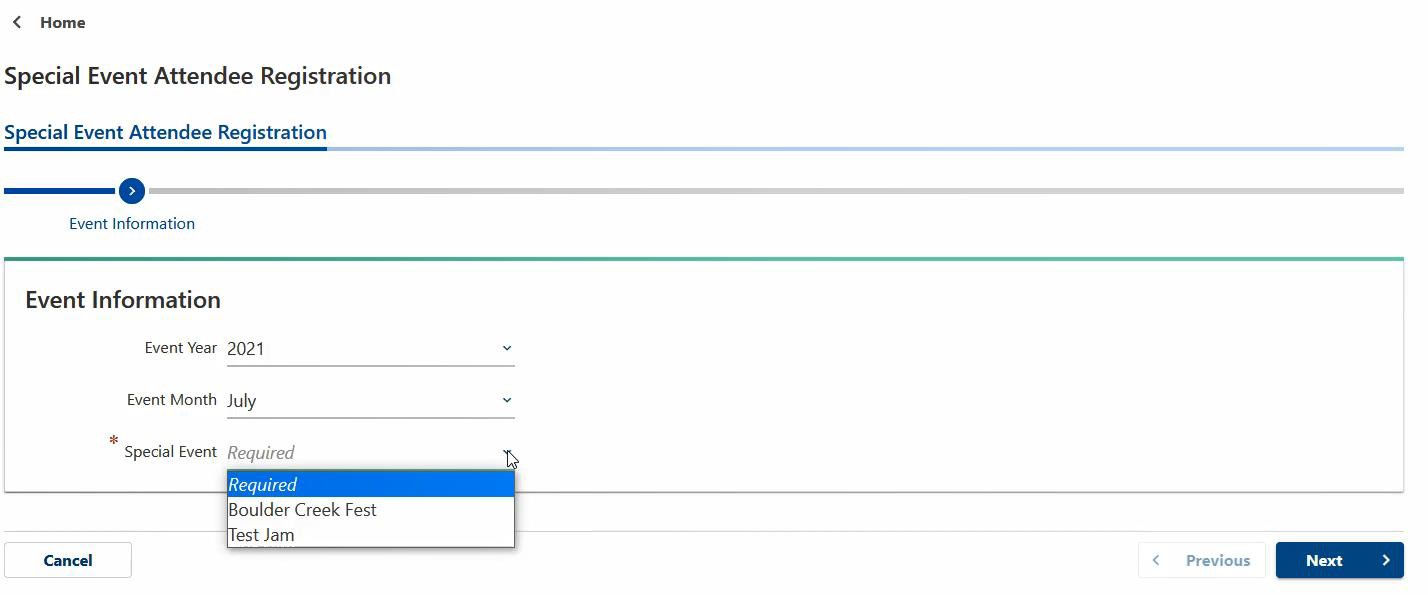

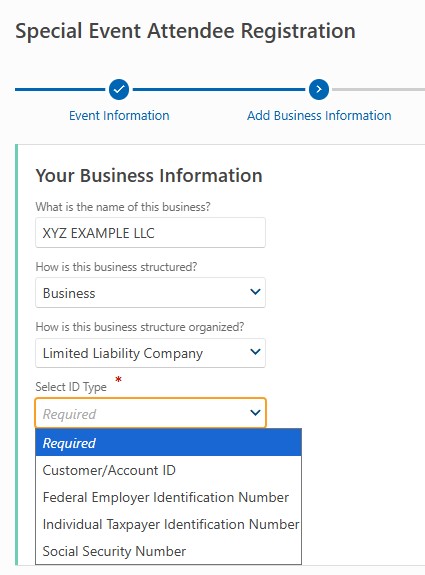

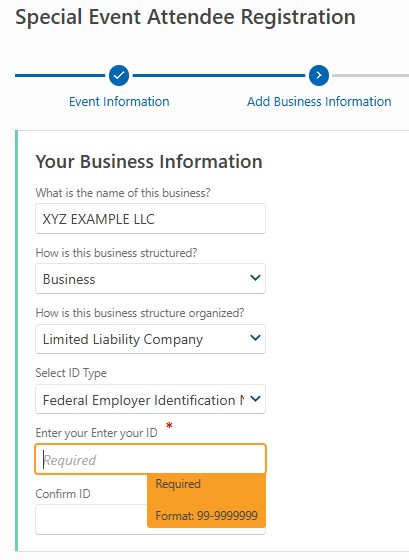

License Required for Attendance

All businesses and organizations attending special events in the City of Boulder are required to obtain a license prior to the event start. Even if no sales are made, a license is required. Special Event licenses are free for all out-of-city vendors. Please note that businesses based in Boulder are required to maintain a business license.

Special Event Licenses are Event-Specific

As a special event vendor, you must register for each event you plan to attend. A return is due for each event registered for, even if no sales are made.

Taxes Collected Are Held in Trust

The City of Boulder thanks you in advance for taking your role as a trustee of public funds seriously.

The City of Boulder Revised Code states: “All sums of money paid by a purchaser to a vendor or retailer as required by this chapter are public monies that are the property of the City. The vendor or retailer shall hold such monies in trust for the sole use and benefit of the City until the vendor or retailer pays them to the city manager.” (Boulder Revised Code 3-2-3)

When is my tax return due?

Special Event tax returns are due up until 20 days after the event has ended. Late returns will be assessed penalty & interest. Tax returns are required even if no sales were made.

Please be thorough when remitting tax. Your accuracy is essential to showing the economic effect of sales and use tax on the City of Boulder.